Mary Kay Ash’s Family is Fighting Over Money

Mary Kay Ash is held up as a brilliant businesswoman who helped other women get ahead. The reality is that she was a predator who preyed on innocent women who wanted an opportunity and believed the public persona. Behind closed doors, Mary Kay was a dishonest charlatan who was married seven times and got rich at the expense of everyday women who put money into a pyramid scheme.

The incredible wealth of Mary Kay Ash now rests with her children and their heirs. The Rogers family collectively has billions of dollars, and now…. they’re fighting over it.

On November 1, 2024, Ryan Rogers, the current CEO of Mary Kay Inc. filed suit against Richard Rogers, his father. Included in the lawsuit are the many beneficiaries of the “Mary Kay-Richard R. Rogers 1975 Trust” (i.e. Mary Kay’s grandchildren and great grandchildren). Beneficiaries of the trust include:

- Richard Rogers (Mary Kay Ash’s son who co-founded Mary Kay Cosmetics with her)

- The children of Richard: Ryan Rogers, Terri Rogers, Rick Rogers (Richard Rogers II)

- The grandchildren of Richard: Aaron Ivie, Geoffrey (Michael) Ivie, Brendan Ivie, Natalie Ivie, Richard (Flip) Rogers III, Renee Rogers, Mariah Bay (aka Mariah Rogers), Marissa Rogers, E.R. (a minor)

- The great-grandchildren of Richard: E.I. (a minor)

At the time the Richard trust was established, Mary Kay set up 16 family trusts for her heirs. In 2021, Mary Kay Holding Company (MKHC), the entity that owns the cosmetics company, Mary Kay Inc., formed two subsidiaries, Golden Rule Management LLC and Golden Rule Investments LP, to manage the family trusts.

This is not the first time there is a lawsuit over the Rogers family money. In 2006, Kathlyn Kerr sued Richard for mismanagement of trusts. Kathlyn is Mary Kay’s granddaughter, the daughter of Marylyn.

Let’s back up a little before getting into the current lawsuit…

Some Mary Kay History

Mary Kay named Richard Rogers the CEO of Mary Kay Inc. in 1987. He didn’t necessarily do a great job, but the company grew anyway. From one news story:

In 2006, Ryan Holl became the CEO of Mary Kay Inc. In 2013, Mary Kay Cosmetics was estimated to be worth $2.6 billion. In 2022, Holl retired and Ryan Rogers, son of Richard Rogers, became the CEO.

“As a young man, my grandmother predicted I would someday lead her company and worked to prepare me by sharing many of her lessons in leadership,” said Rogers, whose father, Richard Rogers, co-founded the company in 1963 with his grandmother. “As usual, Mary Kay was right. I am honored but also energized to have the opportunity to lead my grandmother’s company as we begin our 60th anniversary year.”

Mary Kay’s website currently shows:

Mary Kay Under the Leadership of Ryan Rogers

Things have not run smoothly under Ryan. While the sales directors and national sales directors generally show public support for him, praising how he keeps Mary Kay’s dream alive, behind the scenes, things may not be so happy. Mary Kay Inc. is aggressively cutting costs and the top tier of their pyramid is rapidly shrinking as a result. The retiring national sales directors are a good thing for Mary Kay because it saves the company a lot of money, but a terrible thing for the public image and motivation of the sales force.

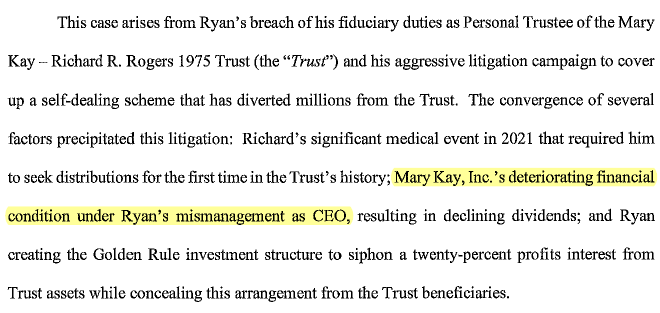

In one of Richard’s filings in the lawsuit, he cites mismanagement of Mary Kay by his son, Ryan:

Did you catch that? Mary Kay Inc. is doing so poorly that dividends stop being paid in 2022. Dividends pay the profits of a company to the owners. Does this mean there are no profits and Mary Kay is losing money?

And Now to the Family Fighting

In 2021, Richard requested significant monthly distributions from the trust. Approximately 70% of the requested distributions were approved and paid. Richard asked for more, and people became upset. In 2023, Richard started asking questions about the Golden Rule entities mentioned above, and he ended up getting a lot of documents that he asked for.

But then in late 2024, Ryan sued his father over these financial issues related to the family trust. (See the case history here.) The parties to the lawsuit in Dallas County court spent much time working to keep the documents out of the public eye. Ryan’s lawsuit was filed with a motion to seal the court records (i.e. make them inaccessible to the public) and thus many of the filings were not available for a year. Richard was opposed to sealing the records because he said it was just a way for Ryan to conceal his misdeeds from the public scrutiny. At the end of October 2025, the court denied the motions to seal, and we got to peek behind the curtain.

Right after Ryan’s lawsuit was filed, Richard asked MKHC to advance him money to pay expenses to defend himself in the lawsuits. MKHC initially advanced him $200,000 for legal fees, but then said he would get no more. Richard sued MKHC in Delaware (where the company is registered) to try to get the company to pay his legal fees. The magistrate ruled Richard was not entitled to have the company pay his legal fees, ending that lawsuit. What is interesting, however, is this excerpt from the magistrate’s ruling:

Before the oral argument, it was reported by counsel that Richard was purportedly removed from his positions as a director and officer of Mary Kay Holding Corporation on October 22, 2025. The removal was executed by Ryan, who is both a Petitioner in the Texas Action and the CEO of Mary Kay Holding Corporation, claiming to vote the majority of the corporation’s stock in favor of Richard’s removal. Following his removal as a director, the Board of Directors purported to remove Richard from his role as an officer. However, Counsel acknowledged that this recent development does not affect Mary Kay Holding Corporation’s obligation for advancement, of which I agree. This matter will not be addressed in the opinion as it does not relate to the primary issue at hand.

So why is Ryan suing his father????

Many years ago, Richard came up with guidelines for the family trust distributions. He said that if only 4% of the liquid assets (other than MKHC) and 20% of the MKHC dividend income were distributed, then the family’s assets would grow faster than inflation. In other words, if you keep the pile of money invested instead of distributing it to the heirs each year, the power of compounding investment returns makes the pile of money much bigger. The idea was that Mary Kay’s family wanted to preserve the family’s wealth to make sure it was there for future generations.

Also, Richard didn’t take distributions from the trust from 1975 to 2021. He was entitled to do so, but chose not to. From Ryan’s lawsuit:

Richard also clearly advised that he did not need or want distributions from the Trust because Richard wanted the Trust to benefit his descendants, not him. Indeed, Richard stayed true to his words after resigning as trustee and, for more than a decade, continued his 35-year streak of neither requesting nor receiving any distributions from the Trust.

That changed in 2021 when Richard and Nancy (his wife of 20+ years) started requesting distributions of $2 million per month. Here’s an interesting email about the money Richard was requesting and some possibilities for paying him. The trust has made the $2 million per month distributions beginning in May 2021 and continuing to the present time.

Ryan has a problem with the distribution request because the annual amount Richard is requesting is equal to the total annual distribution that is due to ALL beneficiaries of the trust. Sounds crazy, right? But remember, since 1975, Richard didn’t take a distribution even though he could have. Ryan says that Richard is now receiving 70% of the money being distributed from the trust each month, while the other 13 beneficiaries split the remaining 30%.

Then in November 2022, Richard requested a lump sum “catch up” payment of approximately $103 million from the trust. His request would have meant giving him 20% of the trust assets and Ryan says this isn’t fair to the other beneficiaries. Ryan was also bothered because Richard wouldn’t prove that he had a financial need for the money. The beneficiaries of the trusts are supposed to provide annual budgets and financial statements so the trustee can assess their needs before making distributions. Richard hasn’t provided the information and refuses to meet with Ryan.

In 2023, Richard requested an additional $5 million to be distributed, since the monthly distributions he started receiving caused him to owe income taxes. The trust approved this distribution.

In April 2024, Richard’s request for the “catch up” distribution was increased to over $138 million. At that time, Richard’s attorneys provided information about Richard’s income and expenses, but did not provide information about his or Nancy’s assets.

Pointing the Finger at Nancy

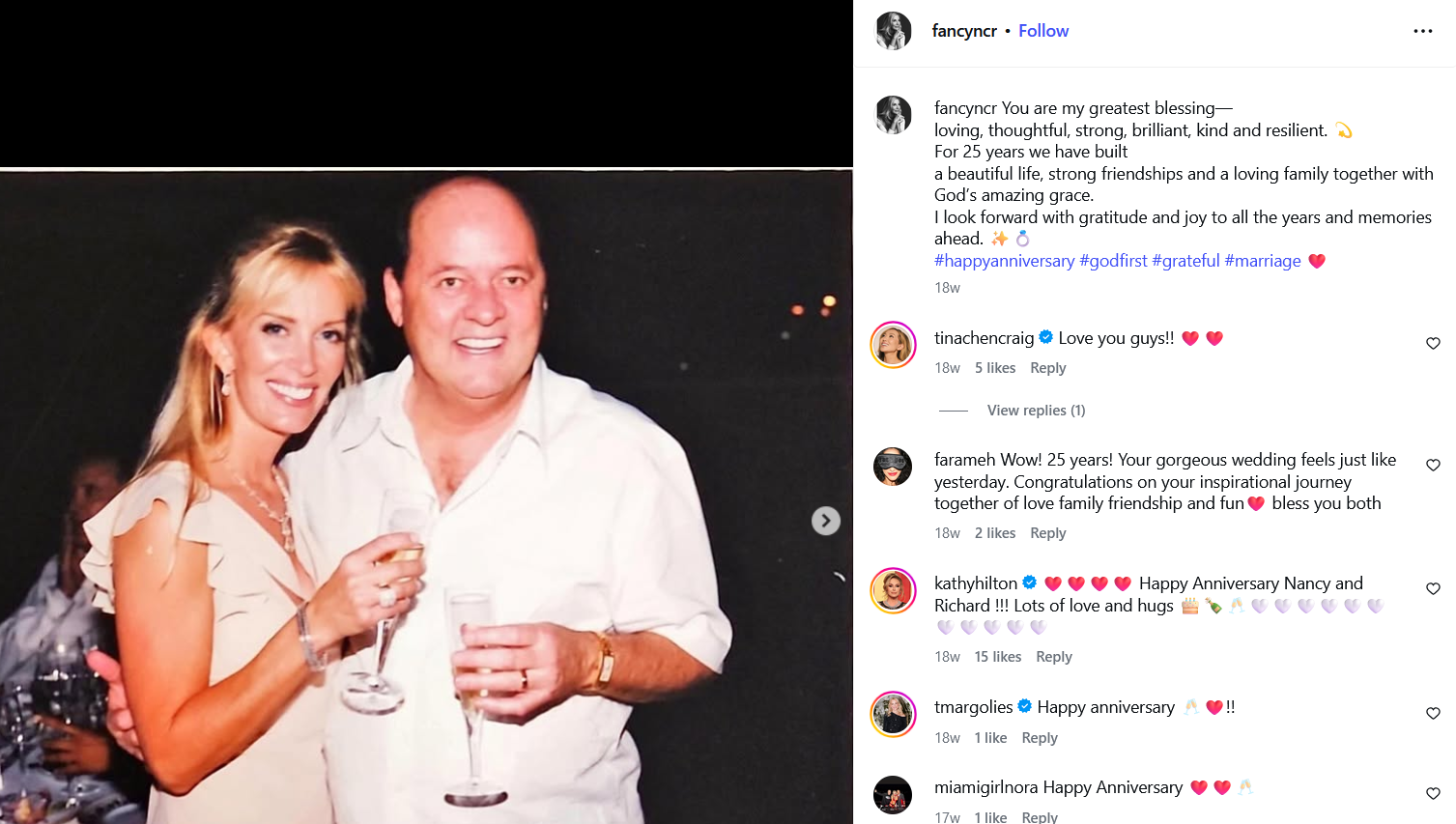

Richard’s third wife Nancy is alleged to be behind all of Richard’s money moves. They’ve been married for more than 25 years according to this August post on Instagram:

Why did Richard want these big distributions? Well Ryan alleges in his lawsuit:

The Co-Trustees also believe that the requested “catch-up” distribution is sought to increase Richard’s personal estate, which, based on information and belief, individuals or entities who are not Trust beneficiaries (like his third wife, Nancy) will inherit. Making the requested catch-up distribution to Richard would exclude the other Trust beneficiaries, violate the Trust’s purpose, and defy Richard’s previously stated intentions.

Ryan says the other beneficiaries are concerned. Well of course they are! Since 1975, Richard hasn’t taken distributions, so the other beneficiaries got to take more. Now he wants his share, and that means they won’t get to take as much. Ryan says dad is OLD and someone might be influencing him, so he needs to have an independent medical exam!

The Co-Trustees are also concerned that the large “catch-up” distribution request by Richard is not a voluntary request made by him alone, because it is contrary to Richard’s own prior guidelines, statements, and actions. The Co-Trustees are concerned that non-beneficiaries are unduly influencing Richard, resulting in his large distribution demands.

Of utmost concern, Richard is 82 years old and in poor health. He is wheelchair bound, medicated, and relies on others to care for him. Richard’s visitations and conversations have been limited and restricted.

For the past three years, Nancy is frequently, if not always, present when Richard meets with the Co-Trustees. She is not a Trust beneficiary, nor does she have any children who are descendants of Richard who would require her to be involved in the Trust. In December 2023, Richard attended one meeting of the beneficiaries of the Trust, and Nancy was also present. Richard appeared via Zoom and, shortly after logging in, his camera was turned off and he was muted. The Co-Trustees asked Richard a question, and he provided a one-word answer before his sound was again muted for him.

In 2022, Richard undertook estate planning changes, including gifting half of his Mary Kay Holding Corporation stock to Nancy.

The Rogers family is concerned about dad passing away and his wife Nancy inheriting money. She can’t be a beneficiary of the trust, since Richard’s interest in the trust will be divided among his heirs (i.e. his children, grandchildren, etc) when he dies.

Terri (Richard’s daughter, Ryan’s sister) comes right out and says all of it.

Yes, things started getting weird.

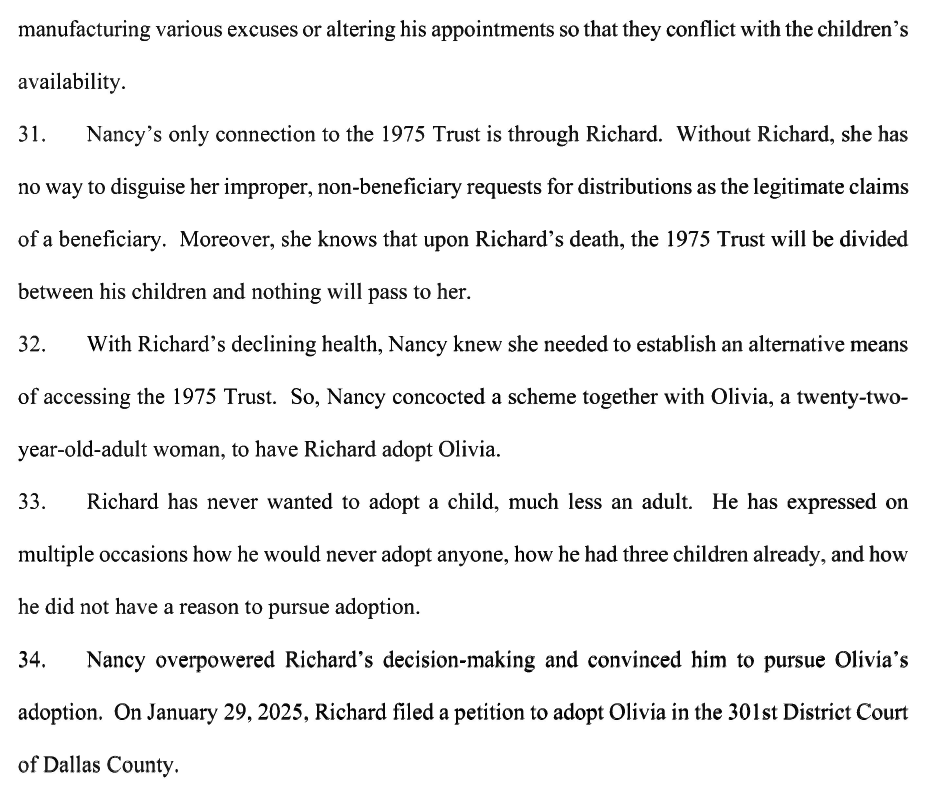

In February 2025, Richard and Nancy adopted an adult, Olivia Abbott. Olivia is 22 years old and has no blood ties to Mary Kay’s family. Olivia’s biological mom appears to be a personal friend of Nancy’s.

Here is little Olivia with her new mommy and daddy:

And here she is in May 2025 with her biological mother, Amy Abbott, a high end wedding planner.

So why would Richard and Nancy “adopt” her?

In one of the court filings (in response to Ryan and Terri’s attempt to undo the adoption), Olivia says:

Olivia Abbott (“Olivia”) has known Richard Rogers (“Richard”) and Nancy Rogers (“Nancy”) for as long as Olivia can remember. After becoming close with Richard and Nancy over several years, Olivia came to live with them while she was in middle school, and Richard and Nancy were identified as Olivia’s legal guardians on school paperwork. As such, Richard and Nancy have made all or substantially all parental decisions for Olivia for many years. At various points over the years, Richard, Nancy, and Olivia had discussed the prospect of formally adopting Olivia to recognize the parental role they already played in her life. In late 2024, the three decided to move forward with the adoption.

Terri says Nancy came up with this scheme so that a share of Richard’s interest in the trust would go to Olivia. Nancy cannot inherit Richard’s share of the trust. It can only go to his children. It appears that this new “child” of Richard is being used to funnel wealth toward Nancy.

The beneficiaries of the trust dispute whether Olivia can be a beneficiary since she was adopted as an adult. There are claims in the lawsuit against Nancy and Olivia for fraud related to the adoption and its true purpose.

From Rick’s (Richard’s son, Ryan’s brother) opposition to Olivia’s motion to dismiss the case against her:

From the allegations in this case, one can reasonably infer that the adoption of Olivia was orchestrated to access Trust assets. The adoption occurred in the midst of contentious litigation, soon after the Trustees challenged Richard’s request for a large catch-up distribution and sought an Independent Medical Examination of Richard’s health. Petitioners have raised their concern that Richard’s large requests are being used to enrich his estate and support non-beneficiaries, rather than for HEMS purposes as the Trust directs. From the allegations, it is plausible that this sham adoption is being used as a mechanism to leverage the Trustees and Beneficiaries in this lawsuit. Such an adoption, however, would contravene the settlor’s intent in creating a family Trust to provide for HEMS support of Mary Kay Ash’s family. The Court should see this for what it is “an act of subterfuge which in effect thwarts the intent of [Mary Kay Ash]” and “cheats the rightful [beneficiaries]” out of security provided by the Trust.

Richard’s Claims Against Ryan

Richard has filed a counterclaim in the case. In various filings he has made allegations:

- Ryan created the two Golden Rule entities to “siphon” profits from the trust and other Mary Kay family trusts into Ryan’s control

- Ryan has engaged in a self-dealing scheme to misappropriate the Mary Kay family wealth for his personal use and enrichment

Richard’s counterclaim was not made available on the court’s website, even after the order denying the request to seal documents. We’ll see if it becomes available at some time. But some of the claims he is making show up in other documents.

In one of Richard’s filings, he discusses:

As I understand this, Mary Kay paid dividends to the trust as well as to Richard personally. Richard lived off the dividends he personally received, which played into his decision to not take any distributions from the trust.

Remember: Richard started Mary Kay Cosmetics with his mom. The money in the trust all originated from MK. In other words, this is his money!!! Yes, he has set his heirs up financially, and has always said he wants them to have wealth for generations. But it all started with him and his mom, and it’s interesting to see the heirs fighting to stop Richard from accessing the money.

What’s Next

One thing is clear: There are lots of lawyers who are going to make lots of money from the Rogers family fighting. I can only imagine that the fees over the last year have collectively totaled a couple million dollars, if not more. This will likely take two or three more years to resolve, but who knows how long Richard will be around. It sounds like he is in very poor health. I can’t wait to see how the adoption of Olivia gets sorted out, and I hope we find out what kind of riches she was promised by going along with this adoption.

On the one hand, it makes sense that Richard may wish to access the money he was entitled to from 1975 to 2021. He didn’t take distributions and let the money grow, and maybe now he wants what is his. On the other hand, I can see that it is possible that his wife is pushing him to make these moves for her benefit, rather than sticking to his original plan of letting the money grow for the benefit of his children and grandchildren. (But also… if Richard wants his wife to access this money and have it after he dies, that’s a decision he’s allowed to make!!!)

But it doesn’t really matter much to me. Mary Kay is a corrupt business and the Rogers family wealth was accumulated at the expense of ordinary women whose families could not afford to lose money. Any blood shed as a result of this family fight will not cause me to lose one second of sleep.

Grab your popcorn and take a seat. It’s going to be a bumpy ride!

Visit the

Visit the

This is amazing! Bankrupt it all!!! (Yes, I recognize that’s going to take much more than this single lawsuit.)

Bunch of entitled nepo babies living off Grandmother’s idea for bilking everyone.

They have billions. It would take a lot to bankrupt them. But as MK Inc circles the drain and the dividends (i.e. the source of funding for the family) have stopped, it will be interesting to see how everyone deals with it. I’m sure it feels like poverty to them.

Few things get so ugly as when certain people feel entitled to money they never earned. Richard’s death will not improve things…just watch as the family fighting just gets worse at that time.

I went through this after my parents passed. I was shocked at the behavior of my siblings. It took just two ungrateful sibs to turn what should have been the straitforward distribution of a modest estate into a family fight from which our large family never fully recovered. The biggest troublemaker remains estranged from the family, and to this day (decades later) still blames his “evil” sibs that he did not “get even more”, even though he was the single greatest beneficiary! I maintain that my father would be rolling in his grave over knowledge of this entitled behavior.

In my opinion, our family would have fared better if my parents had just given everything to charity. So while it might make for good theater to watch the Rodgers family dumpster fire, please glean what you can in how you can protect your own descendants from this type of fighting after you are gone. Be crystal clear with your intentions before you pass, and do your best to leave nothing to interpretation.

Even a modest estate can create huge problems for your heirs, especially if there is sufficient wiggle room in the interpretation of your intentions.

I shouldn’t be surprised at the entitlement of Ryan and his siblings, and yet I am. Yes, dad said he wanted lots of financial security for his heirs. Richard made financial choices for DECADES that benefited his children handsomely. And now, late in life, when he wants to access HIS OWN MONEY, his children are horrified. Their millions are being impacted, and HOW DARE DAD DO THIS TO US.

Reminds me of the family in the 2019 movie “Knives Out”!

If you have not seen this movie, watch it while thinking of Richard Rogers and family!

“…when his greedy and childless third wife wants to access his money in trust for his kids, which he had always wanted to pass on to his children when he was of sound mind before his medical emergency (including throughout the first decade+ of his current marriage), his children are horrified”. FIFY

Ooh, cute insult of “childless.”

I’ll wait for the proof that he wasn’t of sound mind when changes were asked for.

“Childless” just means she doesn’t have a legit way to access the trust for his kids. Also goes to her apparently adopting an adult woman who had real parents already–that doesn’t happen often in the real world. As for “proof”, the parties will offer their evidence obviously, but apparently after Richard’s emergency he’s in a wheel chair, depends on help from others to do simple daily tasks and can barely sign documents, but suddenly does a 180 on his trust vs what he had done for the last 30+ years. Undue influence absolutely happens in situations like that.

Oh DJ I feel for you. When my dad passed several years ago, everything was so simple because I was an only child (my mom died when I was a kid) and the entire estate transferred to me seamlessly. Then my fiancé (now husband) lost his dad, and the three siblings split everything. They actually had me working with their estate attorney because I had just gone through the process and understood it. They all handled it well (except his sister wanted her money and she wanted it NOW lol but she didn’t try to get more than her share) and I was happy to help them. It’s sad when situations like what you went through happen. Of course money is important, we all need it, but family should matter more. Nothing shows a person’s true colors like fighting with “loved ones” over an estate.

However … Richard has not provided the financial documents to back up his requests for a payout. It’s a “HEMS”** based trust, and if you don’t have a need for money, you don’t automatically get it.

**HEMS: Health, Education, Maintenance or Support (usually conservatively interpreted to preserve the trust’s assets)

But but but Mary Kay is family owned and debt free!!!!!!!

Yeah I knew there were fishy financial dealings going on when I left in 2021… things didn’t add up.

Strange statements of growth of the UK sales force, but the sales didn’t grow exponentially which they should have done, if every new sales force member has to place their minimum ‘active’ orders and the increased number of Red Jackets and Sales Directors should also significantly increase the ‘sales numbers’ with their minimum order requirements to qualify for bonuses, which they didn’t.

People including Sales Directors simply weren’t selling any products. We were all struggling as people weren’t wearing skin care or makeup to the same extent as they were before the Pandemic!

Then there was the few millions British pounds UK profits that magically turned into tens of millions GBP losses due to a £21 million ‘loan’ from the parent company, which seemed odd as they’d just moved the UK offices into cheaper premises, they’d moved the warehouse into cheaper premises, they were downsizing the staff, etc. I could just never put my finger on it what was really going on. However, reading all this, if Ryan was moving money around in trust funds and Richard was demanding huge trust payouts around that same time 2021/2022 then things start to make a bit more sense! They may have had money sitting in assets, but the payouts would’ve had to come from somewhere…

And then there’s this weird adoption of an adult, who still has a biological mother she socialises with. That’s just bizarre!!

Nancy trying to scoop the pot before Richard goes to sip cerveza in heaven doesn’t surprise me at all. I mean, it’s a slap in the face to everyone who’s ever had to support a beloved spouse at the end of their life with love, especially the ones who can’t afford proper medical care or don’t have access to it, and don’t have the money to both keep the lights on and pay for medication, but after all, she’s become accustomed to a certain lifestyle and she’s a bit long in the tooth to be a trophy wife for some other rich codger, right?

Nor does it surprise me that Richard’s kids are fighting back. I mean, they’ve spent their lives doing exactly as they please without ever having to worry about money a single day in their lives. What are they supposed to do? Budget, like some peon? Make do with millions instead of tens of millions? My heart positively *BLEEDS* for people who can afford to fling around hundreds of millions like Monopoly money (not).

Olivia surprises me. Quite frankly, I had no idea that one could adopt an adult, especially one with living parents (we know she has at least one). Ok, so her mother is Nancy’s bestie and all, but this isn’t asking to borrow a pair of underwear – this is taking someone’s child. I get that Olivia is an adult, but 22 is still pretty damn young, especially if as I suspect she’s been sheltered and pampered.

Why would she even agree to this? What’s the benefit to her? “Yay! Nancy adopts me and I can have all the lip injections and designer dresses I want!” might seem great now, but what’s her life going to be like 10 years from now? 20? 30? She must have wanted to be something when she grew up. What about her own career plans? Dating? Children? Will she even get to be her own person?

It’s like she’s not even a person in and of herself, but a tool, a means to an end. Nancy is using her in a scheme to get more money. Nancy sucks. Amy sucks, too. My own mother and I had our issues but she’d have moved heaven and earth before letting me make such a rock-stupid move, because she’d have understood the ramifications in a way that I couldn’t, and wouldn’t want to at the time.

Olivia, you deserve better than this. Get the hell out of this madhouse. Go slum it on a friend’s couch (or whatever poor little rich girls do) for a while and figure out what you really want to do.

But what if Richard wants Nancy to have this money? Isn’t it his to do with what he chooses? I think it’s easy to make Nancy the villain. And certainly she seems to have some questionable plans. But they have been married for 25 years and if this is what he wants for her, then why can’t he do it? What if this is completely his idea?

She wouldn’t get the trust money, but presumably Richard has other assets and has made provisions for her in his will.

He didn’t take any money from this trust for ages because he wanted to save it for his children and on down. But if he’d changed his mind and wanted Nancy to have it instead it would he could have done that at any time.

He didn’t start taking distributions until his stroke, ostensibly for medical costs, but there has been no proof that it’s actually going to that and the refusal to have an independent medical exam makes the whole thing seem kind of hinky to me. Also, he’s not medically competent to make big financial decisions at this point.

His old lawyers suddenly being fired and the new ones being sneaky and obstructive.

Her taking the WTAF step of adopting an adult with at least one living parent, a move so far out of left field it loops around the world back to right field. Why would she do that, if not in hopes that Olivia would be entitled along with his biological children to her share of the pot? Furthermore, this young woman seems to be her protegee so it would be easy enough to get her hands on “Olivia’s” money.

Plus I’m cynical, jaded, and just adore drama in other people’s lives when it’s online and I can revel in it anonymously.

I’m also cynical and jaded, but there’s the other side of the story. There’s seemingly no evidence that Richard is medically incompetent other than Ryan and Terri’s say-so. Strokes come with a range of impacts. Maybe he’s wheelchair bound but completely mentally there. Maybe not.

Maybe Nancy is taking advantage of an old man and cheating the trust. Maybe Richard’s fed up with his greedy kids and trying to cash in on his rightful share of his trust to leave to the wife who’s cared for him for the past 25+ years.

All we have here is a whole bunch of bad actors fighting over money they never earned in the first place, which was originally earned by cheating oodles of women out of THEIR hard-earned cash. The only foreseeable outcome is making all the lawyers rich.

I feel no pity for any of them, and don’t trust any of them as far as my preschool kid can throw my fat, post-Christmas gorging self.

Ok, I’ll stop writing soap operas and just enjoy watching the hornet’s nest tear itself apart. Pass the popcorn, will ya? And the hot cocoa.

No no no. I love your commentary. I love everyone’s commentary. It’s all messy and they’re all villains. 🙂

No, Popinki!! Don’t stop writing the soap operas! They must be written. And few have mastered the snarky drama like you.

Let’s just leave space for ALL of them to be the villains they are!

(Pretty sure I had to borrow some exclamation points from the local hun library for that comment…)

I may have to binge watch Falcon Crest, the OG Dynasty, and (of course) Dallas to get some ideas. I already know the women all have to wear hats and gloves, because nothing says “high class bitch” like a really fierce hat.

Let’s see. Richard, during his party boy days, took advantage of a lonely Candomblean priestess, Monat Melaleuca, during a coke-fueled lost weekend in Rio. In revenge, she sent her illegitimate son, Richard’s love child from that affair, to become Richard’s long-suffering chauffer, Rodan Fields. On his mother’s orders, Rodan cast a spell on Richard that saps his will and doses him with a potion (he’s in cahoots with the cook, Lula Roe, okay?) that keeps him in a mental fog. Of course, Richard is aware of Rodan’s shenanigans and only pretends to take the potion (Lula told him; she’s playing a double game) and act dopey. Because he knows Lula is secretly the long-lost heiress to the ancient Duchy of Bellame, which can only be reclaimed with the assistance of a naive ingenue…

Meanwhile, Nancy and Terri start making catty remarks at each other, which turns into a slapping match! Red lipstick smears white gloves! Zippers pop! Then they yank out their hatpins and start an Errol Flynn fencing match!

I either have to lay off the cold medicine, or take more of it.

Take MOAR!

What a great Lifetime Movie this would make!

I love your commentary here. The tricky thing is that I could make an equally compelling opposite argument for all of it. He wanted the kids to have it, and he is allowed to change his mind and give more to Nancy whenever he wants. He can ask for what is effectively his own money at any time, and for any reason. He’s not been proven to be incompetent, etc. I could go on, but you get what I mean. I’m not arguing with you, just pointing out that all of these arguments have an equally plausible counter-argument. The whole Olivia thing is either blatantly dishonest and sneaky, or massively brilliant and clever. I haven’t decided which. 🙂

It’s DISHONESNEACLEVERILLIANT! Even though the sound of it is something quite… uh…

Yeah, even Mary Poppins ain’t finding a rhyme for that one.

The fighting that comes from family members of their loved one in the hospital is ugly at best, especially when there is money (of any amount) in the equation. Family members will keep the Crypt Keeper a full code and want all measures to keep them alive so their cash cow doesn’t dry up. I’ve seen firsthand people like Nancy (who may or may not be the villain here) pull heinous, sneaky AF tricks to get their hands on trusts and assets that were never meant to be theirs. However, my spidey senses tell me she’s pulling the strings to get her hands on money that belongs to Richard. The sham adoption, the meetings where she inserted herself, the firing of lawyers, and the requests for significant sums of money are pretty suspect.

If I had to make an estimated guess on Richard’s health, based on what is in the lawsuits and reported info, Richard likely has some form of vascular dementia as a result of his stroke (which is not uncommon at all). He may not be cognitively intact and possibly lacks capacity, and therefore he should NOT and cannot make significant financial decisions. (Which also begs the question of who is acting as a fiduciary for him and working in his best interest? Nancy comes off as working in HER best interest.) I agree with his children that he needs an independent medical evaluation, including mental and cognitive testing. This is going to get messy for the family.

I also wonder what the other two children of Mary Kay Ash have to say about this. MKA created a trust for each of her children and their heirs. Are those children fighting with Ryan like this? Are they not receiving distributions/payouts, too? Have they picked a side?

There are multiple independent trusts, so this fight between Ryan and his father over this trust does not affect the others.

Marilyn and Ben, Mary Kay’s eldest children have passed away years ago.

The link of Kathlyn, Marilyn’s daughter, accusing Richard of mishandling trust funds is linked in the article above: http://www.pinktruth.com/wp-content/uploads/2006-trust-lawsuit.pdf

So yes they’ve been feuding for nearly two decades now!

It wouldn’t surprise me if there’s more as the obituaries for Ben sound like his daughter Karen has tried to get him the recognition he deserved but never received: https://www.findagrave.com/memorial/210593076/julius_ben-rogers

It really does read like a real life soap opera!!

OH! Findagrave has just filled in a mystery about Ben Sr. He married his second wife in 1945!

I’m with the ‘shroom lady … he could have asked for payouts at any time in his 25 year marriage if he wanted to make sure Nancy was taken care of, but it isn’t until he has a medical crisis and is incapacitated that the requests begin?

The fungus is among us!

Olivia’s fake adoption is what seals the deal for me. Greedy trophy wife and her shady accomplices go to grotesque lengths to get their hands on money that was never meant to be theirs.

“But they have been married for 25 years and if this is what he wants for her, then why can’t he do it? What if this is completely his idea?”—

But it seems he didn’t want that for all those years until the medical event happened in 2021! I think that’s awfully suspicious. He also gifted half his stock in 2022 to Nancy. Why not in the many years before that? Why only after the medical event? Again, suspicious.

Theory: Richard knew that Nancy was his third wife…he knew she was a younger, trophy wife….and he absolutely did want to protect the heirs.

Any benefit of the doubt that might’ve been given to Nancy was removed, imo, when she concocted the adoption scheme. That, on top of the timing when this all began. And, their obvious mismatch as a couple.

***********

Not trying to defend Ryan. Just some thoughts:

Is it possible Ryan created the new entities and was diverting money, end of 2022, because he learned Nancy was looting the trust? A trust that his father never wanted to go to Nancy, nor did he even collect from during his mentally healthy lifetime.

They’re also blaming Ryan for MKI’s downfall. But, it is an MLM company in 2025. We have been predicting its decline for a few years given the state of MLM. Should Ryan really be blamed? So many other MLM companies have bitten the dust – or have gone affiliate.

Yeah, it doesn’t look good for ol’ Nanc’. I’m not here to defend her necessarily, but it is possible that he changed his mind. This whole thing could go either way. 🙂

Ryan’s a tool. I don’t know if it’s his fault or not. But I LOVE that he is getting blamed.

Also, the shenanigans that led up to his lawsuit from 20+ years ago began not long after he married Nancy. Hmmm…

I don’t feel the least bit sorry for Olivia. She’s not a six year old being used as a football in her parents’ divorce, she’s a grown adult and probably a spoiled brat and knowingly in on the scheme to get Nancy’s mitts on the money.

I’d say Mommie Dearest Nancy better watch her back, her shady fake daughter might want to get rid of her and, with a duffel of all of the cash, go skipping home to her real mother.

I’d laugh if Olivia and Amy plan to double cross Nancy’s double cross. Then they’d better watch each other…

And the survivor better watch out for the cleaning lady…

Tracy, when you started Pink Truth so many years ago, did you ever imagine you’d be making such a post? Mind boggling, it is!

*orders popcorn by the ton*

I really never believed MK would be circling the drain like this. No dividends since 2022. Yikes!

Plus Covid gave MLMs an artificial boost. After the survivors came back to work and real life, that MLM bubble popped and it never recovered. It wasn’t long after that many dropped the MLM model or went out of business completely. Plus younger people are used to just clicking a button to get stuff that will show up the next day. Recruiting and holding product parties or whatever is too much of a headache.

Tracy, this is such a good post!

And to think we still wouldn’t know about this if a consultant wasn’t complaining about the My Shop changes in a facebook comment!

Thank you thank you. It was so much work, but so satisfying. 🙂

Tracy, thank you for your hard work. This was amazing!

I’m just picturing all the Kbots who hate read this site spreading links to this article like late blight on a tomato farm. Hopefully it makes a few scales fall away from a few eyes and they get a good look at this family they’ve been supporting and worshipping for far too long.

Excellent article- you deserve an award for putting into clear terms how both corporate leadership and Mary Kay’s family lack any sense of integrity and morality. Greedy, horrible people.

Thank you!

Thanks Tracy for getting this out there….and for the explanation of it all. It’s mind blowing … all the details exposing the family.. cracking the shell, so to speak. The love of money does terrible things to people. It will be interesting to watch it all unfold over time. I do believe we are seeing the beginning of the end of MK… for which I’m so very glad. But like we’ve seen other consultants do before, there are other MLM schemes out there that will gladly take them in, and continue to fleece them of their cash. This may be big enough of a scandal for some to wake up and walk away… for others, it will be on to the next MLM pipe dream.

It’s amazing to me that the media has not made mention of this lawsuit. Thanks to our pink truth members for finding it so we could discuss!!!

Here’s a great article with background on Richard’s billions:

http://www.pinktruth.com/wp-content/uploads/richard-rogers-billionaire.pdf

What a community we have become!!! All of the mess was well worth it. Tracy, you talked me off the ledge many years ago and look what you have achieved! Wow.WOW. Wowwowowowowow! Love you more!

Tracy, WHAT an article! We KNEW that shady things were behind all of these financial decisions but not this. You are like Toto pulling the curtain aside and showing us the reality of Oz. Thank you.

Wayyyyyyyyyyyyy ot but maybe not, what was that article in a Dallas paper about John Rachon? CEO? Tents over a a glass pool floor for a party– leaving the company suddenly? Help.

Is this it?

https://www.dmagazine.com/publications/d-magazine/2004/march/not-so-pretty-in-pink/

It’s the later part of the article Tracy led off with. “Mary Kay Inc. will tell a very differentstory, one that casts Rochon as a spendthrift executive who hid thingsfrom Rogers, including a plane, a building, and a tent. The tent, inparticular, appears to be of utmost importance. They will talk forhours about the tent.”

Yes! Printed it out so now I have it!! Thank you! XXOO

To be honest Richard himself isn’t exactly squeaky clean and it wasn’t him who put up the money to start the company, nor was it Mary Kay Ash or Mary Kay Hallenbeck as she was then (for a whole month!) The majority of the $5,000 in hard earned savings that started the company came from Ben J. Rogers Jr, the eldest son of Mary Kay and Julius Ben Rogers Sr.

When George Hallenbeck suddenly died of a heart attack, Mr Hallenbeck was in Multilevel Marketing himself, the sons were called to help their mother launch Mary Kay Cosmetics.

Ben emptied his savings account and sold all his assets to help propel his mother’s fledgling company. In September of 1963 Mary Kay Cosmetics was born. Ben left his $650 per month job at Lyons to move his family to Dallas and make $250 per month working with his mother and brother. Within two years Mary Kay Cosmetics had sales of $1 million.

(This from his obituary both on Find A Grave and in The Dallas Morning News and corroborated as well as in “Ask ME about Mary Kay: The True Story behind the bumper sticker on the Pink Cadillac” by Jackie Brown, who was one of the first Mary Kay Consultants and Sales Directors.)

Strange that Ben is never mentioned in the history of Mary Kay Cosmetics, just like at least 4 and possibly 6 of Mary Kay’s husbands got erased from Mary Kay history.

Jackie Brown paints a not so rosy picture of Richard and Mary Kay in those early years. The 7 to 9 marriages of Mary Kay, even her marriage to Melvin Ash (whose name wasn’t even Ash!) was quite odd, he disappeared the day before their wedding and later reappeared and they had a small wedding ceremony, nothing like the big wedding they had initially planned. Richard and Mary Kay made Jackie believe she was going to be a National Sales Director and painted a picture on a board – very much like Amway still does these days – about all the circles of ‘Units’ and ‘Sub-Units’ only to tel her she had misunderstood it all when they realised they’d have to pay out huge bonuses if they did what they promised at seminar.

Even then they were greedy. There wasn’t a single thought about empowering women and lifting women up, not very Christian at all.

A multi billion dollar castle built on lies; a castle of cards that looks like it is coming crumbling down more than 60 years after its inception.

When George Hallenbeck died, he and Mary Kay already had the product and the marketing plan solid, getting ready to launch … George was in sales, perhaps chemical industry sales.

I have a very hard time tracking much about George because the “other” George Hallenbeck was the lead surgeon trying to save JFK and it swamps the search results.

Whoa– this is all news to me…

So, the annual payout from the dividend went from 39 million in 2016-19 to 10 million by 2021 and Richard, or “Richard” had to use HIS savings and dive into the trust to maintain “their” lifestyle.

Per Nancy’s instagram it’s a lifestyle of flying via private jet or sailing on yachts all over the world with her celebrity friends on very expensive vacations, shopping extravaganzas, and trips to fashion shows. You mean they refused to scale down and live a more modest life adjusting to the reduced cash flow?

Curious she has WAY more photos of herself with Kris Jenner than with Richard. He’s barely there.

Keeping up with the Kardashians has its price.

Wow I thought my in aws family is a mess. This is such a mess!

Little Ryan Rogers in 1993

Was his step mom even born?

Nancy is in her 60s. Yes, there is a 20 year age gap between her and Richard.

Ryan and I are almost the same age (I’m a couple of weeks from 52). Nancy there is closer in age like an older sibling than a step-parent.

I’ll be 50 in March, which means I’m not too far in age from Ryan, either.

That explains why he looks like all the dorks I graduated with. But at least the dorks I graduated with were good guys.

I don’t find it to be a big deal. I have several friends with 20+ year age gap marriages.

It’s really strange that one woman had so many husbands that died.

Ooh, I’m stealing that for the next episode of my soap opera, “The Pink and the Wretched”!

Like Henry VIII’s wives habit of falling downstairs onto sharp blades.

I’d like to see a deep dive on all of her 7-9 marriages. How did she meet them? What was the age gap? Was she a golddigger looking for a payday or a full on black widow? She was such a scumbag I wouldn’t put it past her.

Lazy Gardens has done a pretty good analysis with the information available. Somewhat stymied by lack of available information–MK did a lot of work during her lifetime to hide most of this information, and the internet wasn’t a thing when she was marrying, divorcing, and murdering for inheritances. (Joking about that last one, but why not add to Popinki’s drama?!?)

I was a proofreader and editor of her autobiography in 1980-1981. It started to become clear working on the book there were more husbands than she’d previously mentioned. No one wanted to confront her about it so we went along with her version of her life. It was her story to tell.

Sure, it’s her story to tell. But is it her story to lie about? Her many husbands may take issue with the lies if they were alive.

I wonder what she would think of her new granddaughter.

Little Olivia…..

I linked to the marriage article in this article.

https://lazygardens.blogspot.com/2015/04/mary-kay-ash-and-missing-marriages.html

Rogers – divorced (married wife #2 in 1945?)

Eckman – died

Weaver – divorced

Louis and Miller – unconfirmed

Hallenbeck – died

Ash – died (at 75)

Tune into the next episode of “The Rich and the Reckless, Dallas,” next week.