Bankruptcy Attempt By Mary Kay NSD Mia Mason Porter

Written by Frosty Rose

Written by Frosty Rose

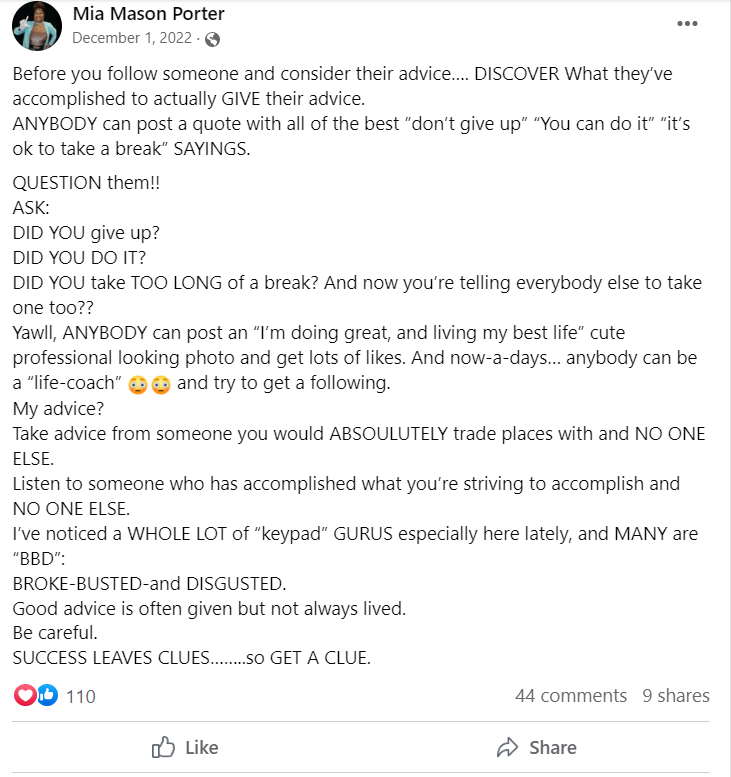

National sales director Mia Mason Porter is the stuff of Mary Kay legend. Debuting as an NSD in 2012, she became the younger half of the first African American mother-daughter NSD pair in company history. She has it all! The glitz. The glamour. And, per typical of the position, some pretty strong opinions that she likes to spew on social media. Let’s take this quote, for example:

Not bad advice, actually! So, I took it. Let’s DISCOVER what Mia’s all about, shall we? Surely, she can’t be one of the keypad GURUS that she calls out in this post. Right? I’ll let you decide.

I, for one, look up to people who are financially stable, especially when they’re offering advice on how to become so myself.

As an elite, top-of-the-top, NSD, surely Mia is financially stable? Nope!

A very quick Google search (followed by Tracy doing that thing she does) shows that she and her husband filed for bankruptcy in October 2019. (See the documents here!) Wait, bankruptcy? Rolling in all that cash as an NSD? And not even mommy’s NSD money could bail them out? *clutches pearls*

Per their bankruptcy filing, the Masons owed:

Per their bankruptcy filing, the Masons owed:

- $119,000 to the Georgia Department of Revenue

- $5,400 to the IRS

- Almost $39,000 in total credit card debt (that’s a lot of discontinued lipstick stockpiled!)

- Hospital bills of $208,000 (yikes!)

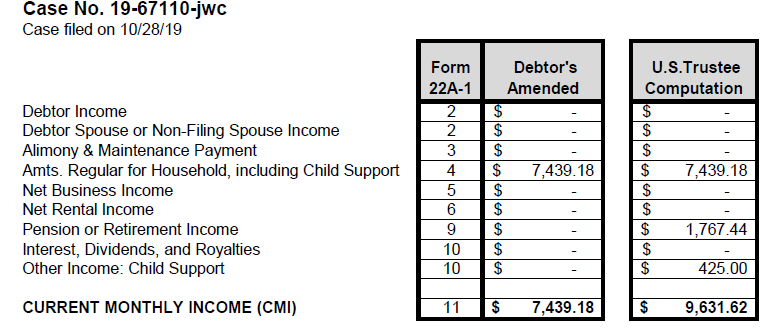

And this document gives us a behind-the-scenes look at the real earnings of a national sales director. In this case, she declared a net income from Mary Kay of $6,958 per month, or $83,496 per year!

Hold. The. Phone! So you’re telling me that not even NSDs are earning that elusive six-figure income?!? But… but… my recruiter told me that more women are earning six figures in network marketing (ahem… MLMs) than any other career in the US!! Surely, she couldn’t be lying?!? Somebody grab my smelling salts!

Let’s set that bombshell aside and discover something else about Mia to admire. Right? There must be some redeeming quality. When I’m deciding who to look up to, I highly value integrity and the ability to be honest in all circumstances. Mia has reached the summit of the mountain (er… pyramid) in Mary Kay, one of the most respected, honest companies on the planet earth. Surely, she’s a woman of integrity?

If you said no, you guessed right.

Per their bankruptcy filing, the Masons had no disposable income to pay their debts. Ok… sure… I half believe this because of the abysmal earnings we consistently see from the MK sales force. But the bankruptcy court dismissed their case (i.e. they still have to pay their debts) because they lied. The Masons claimed that they had negative monthly income… meaning that their monthly expenses were more than their monthly income, so they had no money at the end of the month to pay any debts. But the bankruptcy trustee found that Mia and her husband actually had $1,443/month of disposable income with which to pay debts.

How does that happen? Well it starts with the fact that Mia didn’t bother to report all of their income.

Sigh.

Back to fiscal responsibility. In April 2022, just two and a half years after this attempt to ditch out of their debts, the Masons bought a new home, a literal mansion, valued at $694,900. The mortgage they took out to buy the house? $719,916. Which essentially means that they had no down payment and rolled all costs into the loan.

Back to fiscal responsibility. In April 2022, just two and a half years after this attempt to ditch out of their debts, the Masons bought a new home, a literal mansion, valued at $694,900. The mortgage they took out to buy the house? $719,916. Which essentially means that they had no down payment and rolled all costs into the loan.

But how could they qualify for a mortgage so high? They would have needed to show about $240,000 in income to qualify for a mortgage of this amount. So their income doubled (from the trustee’s calculation) in the less than three years since they filed for bankruptcy???

What I can’t figure out is if they were lying in the original bankruptcy filing (more than the courts already determined). Or if they were lying when they secured the mortgage.

Just like Mia says in the above Facebook post:

“SUCCESS LEAVES CLUES….so GET A CLUE.”

We got a clue, Mia, and it tells me to stay far far away from you!

‘Cause right now, you look “BBD”: BROKE-BUSTED-and DISGUSTED.

Visit the

Visit the

What I can’t figure out is if they were lying in the original bankruptcy filing (more than the courts already determined). Or if they were lying when they secured the mortgage.

Adds “Both are good” GIF from Disney’s Atlantis.

No doubt, we will get another busload of MK apologists bleating that this was all in Ms Porter’s past and we shouldn’t rely on it as an indicator of her values in life. Totally in denial about how this affects her family’s present and future.

The hospital bills in particular should be an eye-opener. You can argue that the healthcare system in the US sucks rocks and costs are out of control, and I’d agree with you.

But it proves that health insurance is absolutely necessary and the most straightforward way of getting that is an actual job – either part of the benefits package or enough of a salary to be able to buy coverage through Obamacare (and actually using the money for that instead of stretching production or making copays on your “free” Cadillac.)

With MK, you get nothing, even at the top of the pyramid. N-O-T-H-I-N-G. No insurance. No pension. No guaranteed income. No matter how young you are, or how healthy you think you are, all it takes is one split second to land you in a world of debt you’ll never dig your way out of, especially in an MLM obsessed with fluff and images.

I aree with you 100%.

Looks like Mia signed Michael up to be a consultant the year before they married.

https://imgur.com/a/pgfTAYA.jpeg

Let me get the snark out of my system first.

Why didn’t Mia just sell more makeup and earn enough to pay her debts? After all, your inventory is an ATM. Failing that, her downline should have ordered more so she got bigger commissions. Those lazy loosers aren’t team players. Finally, lose the Michael Jackson glove. The “loser” sign works, though.

Ok, that’s better.

They filed for Chapter 7, which stays on your credit record for 10 years. Does that still apply even though their case was denied? How the holy fuzzy bunny rabbits did they manage to get approved for a $700K+ mortgage (with no down payment??) with a land mine like that on their credit report?? Actually, how the hell did they score that kind of a loan, since their credit ratings must have been in the toilet already, since they were that far behind on their state and federal taxes and with that much credit card debt?

If they had been allowed to go through with the bankruptcy, a trustee could have seized some of their assets in order to sell them and pay off some of the debt. I wonder what the trustee would have made of the truckload of expired MK makeup Mia must have laying around the place.

“Remember, girls, don’t forget to offer the opportunity to your trustee!”

I’m pretty sure the bankruptcy wasn’t on their credit report bc it was denied. I’m surprised they didn’t try for Chapter 13. But, perhaps they were trying to scam and get rid of all of their debt. With chapter 13 you pay back a percentage of it.

“ How the holy fuzzy bunny rabbits did they manage to get approved for a $700K+ mortgage”

Maybe Monique Anthony’s new gig is as a mortgage broker and helped her out? I’m only kind of joking…what mortgage professional approved this loan and how is she connected to Mia?

“So you’re telling me that not even NSDs are earning that elusive six-figure income?!? But… but… my recruiter told me that more women are earning six figures in network marketing (ahem… MLMs) than any other career in the US!! Surely, she couldn’t be lying?!?”—

When it comes to MLM, they lie about the amount of money they make to lure people in, and they lie to people about what the “opportunity” is…..in order to make any money at all.

We expose the lack of profit most of them make and claim, but we also expose that a truly “successful” MLM leader, and there are some, is simply the best con artist and liar of the bunch.

No one should aspire to be an MLM leader; it’s all bad.

Deception is the heart of MLM success. The greater the success, the greater the underlying deception. Even “success” is difficult to quantify, since those who are allegedly the “most successful” are also the most deceptive. Meanwhile, nearly all who claim success are actually losing money, while pretending to be successful.

You simply cannot trust what MLMers tell you. Chances are VERY good that whatever they tell you is a half-truth at best (“It’s possible to make money in MLM”, “I made $1000 last month.”), or worse an outright lie (“It is easy to recover the cost of your initial inventory purchase”, “The product sells itself.”, “It only costs $100 to start and run a Mary Kay business, inventory purchase is recommended, but not required.”).

Bottom line: You must be willing to lie and cheat to build and grow an MLM business. This is not optional if you aspire to make positive income. Mary Kay has spent decades creating platitudes, quips and non-sequiturs to help their consultants ignore that inner voice telling them this whole thing stinks to high heaven.

Meanwhile, no amount of cosmetic foundation can ever cover up that MLM smell.

A comment after my own heart. Xoxo Beautifully written!

“L” is for Liar

And P is for Poacher! Love this post you found recently

https://i.imgur.com/PXggwR9.jpg

This would feel so full-circle if she was talking to Monique Anthony.

P is also for “posessive”!

I wish I could upvote this a hundred times. This woman is a real piece of work…a lying, rude, condescending, UNSUCCESSFUL piece of work.

Googling mia mason porter suddenly became more fun.

10/10 would Google again!

Even in the best of circumstances, it would be impossible to only take advice from the successful people in MK, because (even if anyone was successful), all are taught to lie and present a certain image. So how would you even know?

It’s dangerous for her to advise Mary Kaybots to “discover” how successful their mentors are, because they will be sorely disappointed if they really look into it. It’s all hype. Period.

Another NSD embarrassment for MK Corp.

The NSD title is a joke. (Remember, these are the women for whom you “stand when they enter the room.”)

Look at the women (including NSD daughters) stuck at SSD and ESSD for years and still haven’t reached NSD. Yet, you BEE-lieve you can get to NSD by selling lipsticks from your kitchen table? You have NO IDEA what goes on behind the pink curtain.

WAKE UP

She’s definitely BBD;

A BRAGGART, BOGUS and DECEPTIVE.

Someone mentioned above the ugly cost of health care when you don’t have insurance. That’s one thing..and I know plenty of folks who had to put medical debt, and I mean obscene medical debt in into bankruptcy. That being said, pay your taxes, both local and federal, because eventually, they WILL catch up to you and want their money.

I could have felt a bit of pity had there not been the tax bills. A bit.

Doesn’t her husband work?

On the second linked document, he has some small retirement income, just over 21K/yr.

Dunno if that means he retired early (possibly due to injury or illness, cf the high medical bills) or if he’s another wannabe ninja-rockstar-spaceman-preacher-motocross rider-pirate like Jamie and Chelsea’s husbands.

Check that; the medical debts are hers. Should have read the whole thing first.

Looks like he is a fisherman.

There’s a photo of him on her instagram wearing bright yellow pants and carrying a yellow tote alongside a group of women with the same tote.

She’s got a slew of credit cards with fairly low limits that appear to be maxed out. and a couple bank accounts with nothing in them. And $50 cash.

And I just discovered the worst part of this whole situation: they’ve got 2 kids, ages 12 and 15. And those kids have a mother who spent the whole family into a giant crater for the sake of her “business”, a father who’s not doing much to ameliorate the situation, and parents who lied on a bankruptcy filing. I hope the kids have SOMEone in their lives who can teach them to be smart about money and credit, because they ain’t getting it at home.

You all don’t know this lady. Judging her is superficial. She is a very good woman, with a heart of gold. Dont judge. She may have made a bad decision, most of us have and the rest are a decision away. Do you really think someone would put that kinda time into something just to throw it all away. We, the human race, can not wait to pass harsh judgment on someone. I personally don’t care about how she got to the decisions she was faced with because I know her and it had to be a tough decision. Mia keep striving, keep pushing and don’t give up. Thank you for every unselfish thing you did for me.