Cracking Down on Income Claims

Written by Frosty Rose

Mary Kay and its MLM ilk have long tussled with the FTC regarding deceptive income claims. Corporate wrings its hands and proclaims that its consultants are independent contractors and there’s only so much they can do (until it comes to suing the pants off people trying to recoup a fraction of their losses by selling products on eBay).

As a result, the FTC has gotten increasingly strict on how MLMs comply with the prohibition on income claims. And Mary Kay et al. have begun lowering the hammer on their distributors.

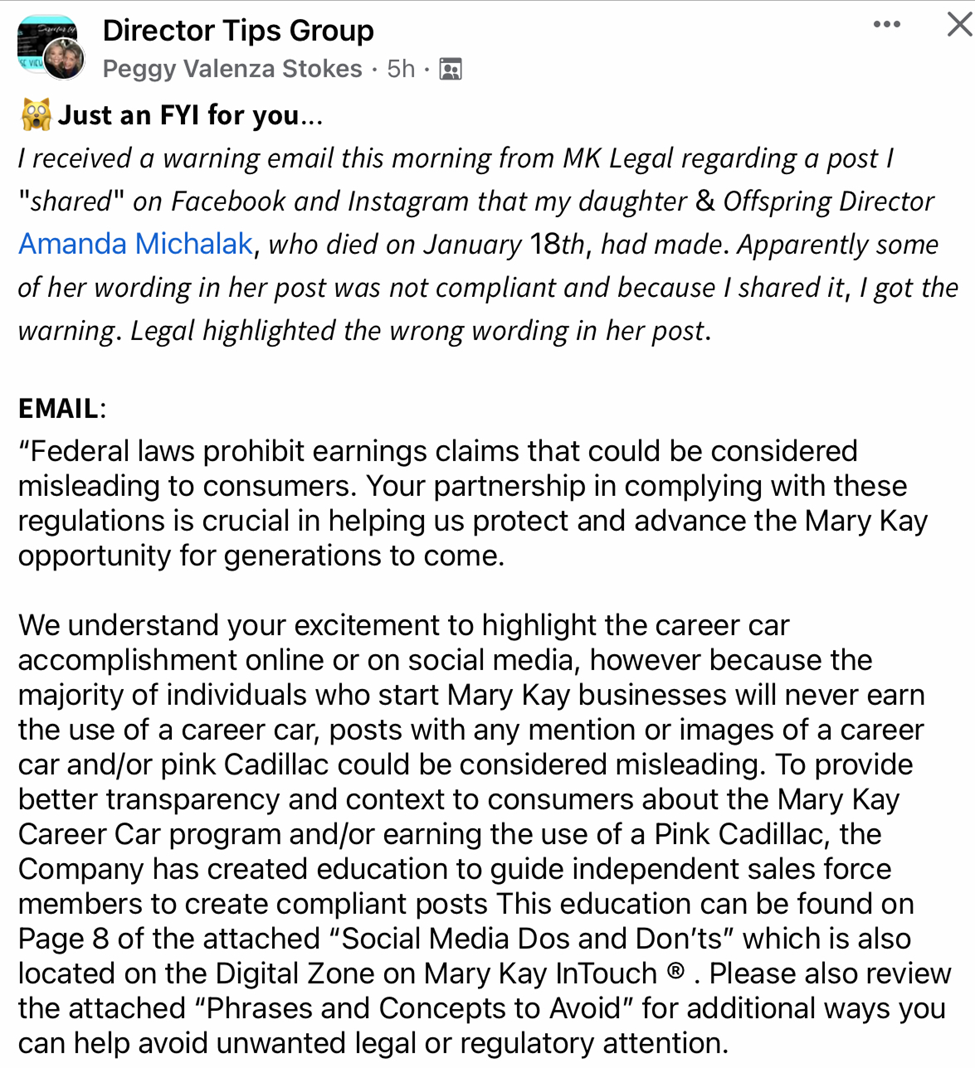

I hope any residual warm fuzzy feelings you may have still harbored for Mary Kay evaporate instantly when you read how Corporate responded to this director sharing a memory post from her deceased daughter, in which the daughter celebrated all her car “wins.”

Truly, Corporate, there was no winning for you in this situation. Do you risk the wrath of the FTC and let this income/car earning claim slide? Or do you tackle it head on, censure a grieving mother, and lose the soft pink image you’ve worked so hard to culture?

Looks like image problems are not as dire as a smack from the FTC, and you’ve opted for the latter. I, for one, would judge you harshly regardless of the choice you made.

Visit the

Visit the

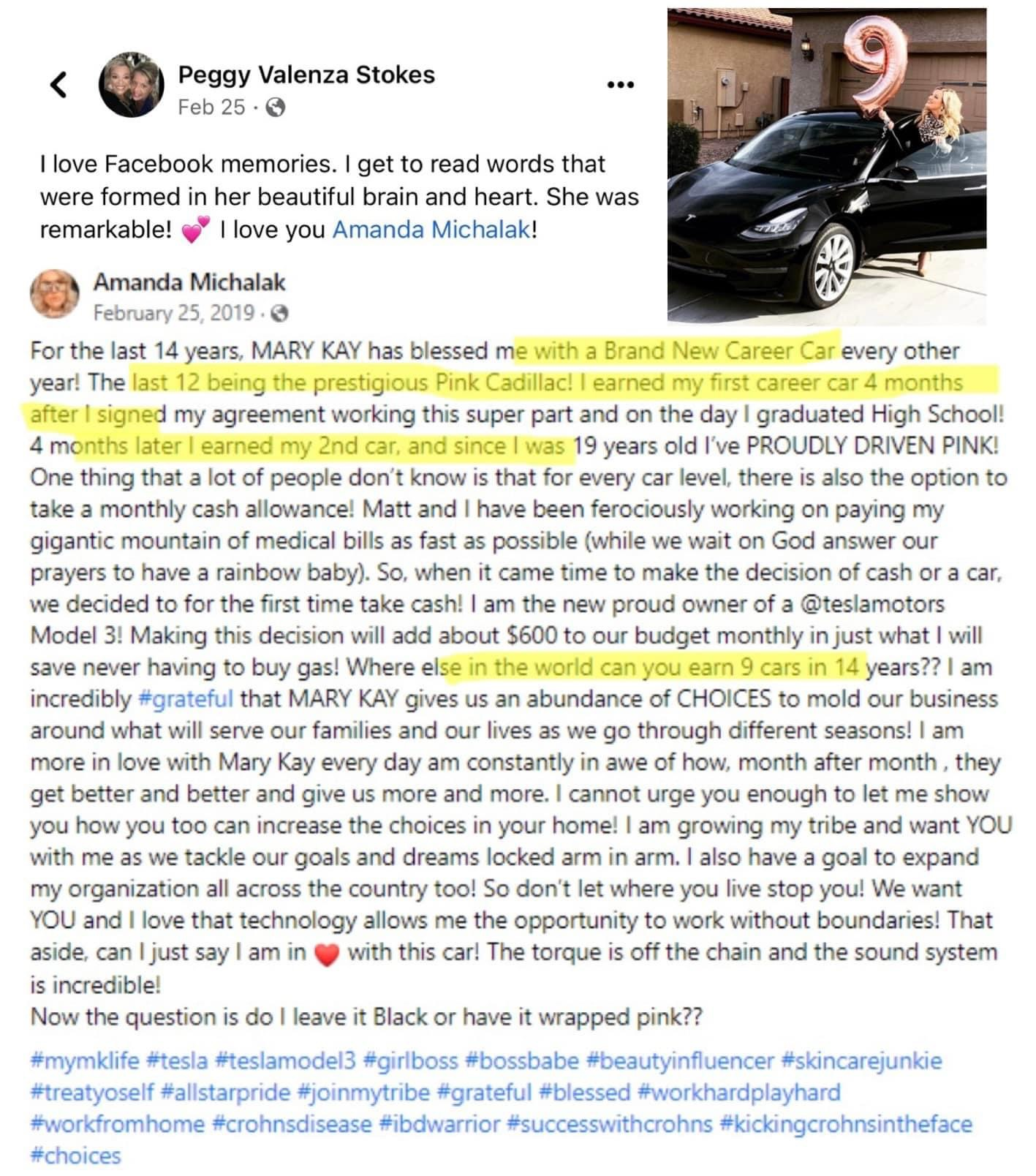

It’s interesting that this consultant is taking the money rather than the car, this time. We have seen plenty of “Hey, hun, look at my new bright, shiny Caddy” posts which have not yet been highlighted on on the various FB groups.

Is MK legal making this a new hammer for all their career car earning their consultants or just those who dare to take the cash alternative?

A former National sales director didn’t take the cash. She was one of the first to start in mk. Instead of the Cadillac, she got a sports car. She was well known as one of the top nationals who earned millions. And yet, her husband had a business selling vegetables and fruit at farmers markets. He had a real business but she was seen as the successful one. Years later after leaving mk, she would have seminars to encourage women…and get paid a lot for one short speech. Lots of mk women would go just to sit at her feet to drink in that Mary Kay celebrity status.

Well, someone should record a recruitment pitch (or a “guest event”) and send it to the FTC then, because this is tame compared to what one would hear there.

Kind of fascinating MK Corp Legal is cracking down on what’s written down, but allows the directors to make all kinds of outlandish income claims.

Also, FTC, how about requiring written income disclosure statements for every MLM? Like Canada does.

The Direct Selling Association (DSA) is a HUGE lobby group in the US. They are one of the reasons you won’t see income disclosure statements.

The majority of individuals who start Mary Kay businesses will never earn the use of a career car.

Straight from corporates mouth!!!

Normal companies not only make income claims, they advertise them on job boards with no legal repercussions. Where is the curiousity on the part of MLMs like Mary Kay as to why they can’t do this?

Of course if MLMs were honest about likely income (negative for 99+% of participants), they’d be in legal compliance…but good luck selling that opportunity!

While we’re asking the FTC questions, I have one:

I found this on the FTC’s site:

4. How does the FTC distinguish between MLMs with lawful and unlawful compensation structures?

At the most basic level, the law requires that an MLM pay compensation that is based on actual sales to real customers, rather than based on mere wholesale purchases or other payments by its participants.

Source: https://www.ftc.gov/business-guidance/resources/business-guidance-concerning-multi-level-marketing

Mary Kay has always paid commissions to the consultants’ uplines based on wholesale purchases, NOT sales to retail customers. How is it that Mary Kay gets away with flagrantly breaking the law like that?

Hmm?

Sorry no sympathy to the “grieving” mother. She was using her late daughter’s post for recruiting purposes. Nothing more disgusting than that.

Exactly. Of all the memories to repost, it had to be *that* one? Come on.

Unfortunately, income disclosure statements will mostly show endless-chain recruiting pyramid scheming commissions, so we have the same problem as with the Schedule C. As a reminder, the IRS instructions state that you combine all your income/sales/commissions in Part 1, line #1 of the Schedule C. (It’s all mixed together.) I would also like to add additional IRS instructions re the Schedule C:

“Income from illegal activities, such as money from dealing illegal drugs, must be included in your income on Schedule 1 (Form 1040), line 8z, or on Schedule C (Form 1040) if from your self-employment activity.

I don’t want to know how much a pyramid schemer makes or doesn’t make, and I don’t want to know how much a drug dealer makes either. I want to know *how* they do it before associating with that “business”.

If they are advertising a product sales business, they need to provide income disclosure for product sales to non-affiliates. Since we know that MLM defaults to recruiting, except for a few outliers, they can’t.

For the company, there are sneaky ways around trumping the retail numbers. For example, Mary Kay crediting all orders as retail sales, and I believe Amway has similarly reconfigured their “accounting” for retail sales.

If we use the IDS and the 99% loss rate for its dissuasion to join, I still don’t think it would be effective. MLMers have tactics to address this. The dupe might assume, and definitely have it suggested, that the other 99% are lousy business owners lacking the sales skills to move product and recruit; were unwilling to learn the skills; didn’t “believe” in themselves; are lazy, etc., etc.. If they are susceptible to being brainwashed and conditioned to rely on faith, trust, belief, the facts/numbers won’t matter anyway. Practical questions are dubbed negative, and it is implied that the person “doesn’t get it” and is lacking. And so on.

When I see any claim, disclosure, or Schedule C relevant to MLM, that reads to me “successful pyramid schemer” or “failed pyramid schemer”. In both cases, you’re a pyramid schemer, although the latter suggests you’re a lousy liar. That’s a good thing. An MLM company is a product-based pyramid scheme, and Mary Kay is an MLM company.

At the very least, any disclosure should differentiate what amount is recruiting commissions, and what amount is non-affiliate sales commissions. If they can’t (they can’t and/or won’t), then that itself needs a disclaimer in big bold letters. And do I think that will even work? For most, No.

At the end of the day, MLM uses the cult tactic of selling dreams/opportunities/paradise. When did facts ever matter to that type of selling?

Unfortunately, income disclosure statements will mostly show endless-chain recruiting pyramid scheming commissions, so we have the same problem as with the Schedule C. As a reminder, the IRS instructions state that you combine all your income/sales/commissions in Part 1, line #1 of the Schedule C. (It’s all mixed together.) I would also like to add additional IRS instructions re the Schedule C:

“Income from illegal activities, such as money from dealing illegal drugs, must be included in your income on Schedule 1 (Form 1040), line 8z, or on Schedule C (Form 1040) if from your self-employment activity.

I don’t want to know how much a pyramid schemer makes or doesn’t make, and I don’t want to know how much a drug dealer makes either. I want to know *how* they do it before associating with that “business”.

If they are advertising a product sales business, they need to provide income disclosure for product sales to non-affiliates. Since we know that MLM defaults to recruiting, except for a few outliers, they can’t.

For the company, there are sneaky ways around inflating the retail numbers. For example, Mary Kay crediting all orders as retail sales, and I believe Amway has similarly reconfigured their “accounting” for retail sales.

If we use the IDS and the 99% loss rate for its dissuasion to join, I still don’t think it would be effective. MLMers have tactics to address this. The dupe might assume, and definitely have it suggested, that the other 99% are lousy business owners lacking the sales skills to move product and recruit; were unwilling to learn the skills; didn’t “believe” in themselves; are lazy, etc., etc.. If they are susceptible to being brainwashed and conditioned to rely on faith, trust, belief, the facts/numbers won’t matter anyway. Practical questions are dubbed negative, and it is implied that the person “doesn’t get it” and is lacking. And so on.

When I see any claim, disclosure, or Schedule C relevant to MLM, that reads to me “successful pyramid schemer” or “failed pyramid schemer”. In both cases, you’re a pyramid schemer, although the latter suggests you’re a lousy liar. That’s a good thing. An MLM company is a product-based pyramid scheme, and Mary Kay is an MLM company.

At the very least, any disclosure should differentiate what amount is recruiting commissions, and what amount is non-affiliate sales commissions. If they can’t (they can’t and/or won’t), then that itself needs a disclaimer in big bold letters. And do I think that will even work? For most, No.

At the end of the day, MLM uses the cult tactic of selling dreams/opportunities/paradise. When did facts ever matter to that type of selling?

I feel bad her daughter died. That’s sad.