How to Do It Right and Make No Money

Written by Frosty Rose

Pink Truth Critics are notorious for using the same tired arguments for why Pink Truth is wrong and Mary Kay is the greatest thing since sliced bread. For my answer to “You just didn’t do the work,” see yesterday’s article.

Today, let’s tackle the ever-popular “Income disclosures don’t tell the whole story. Most people are making tons of money from sales.” For those who aren’t familiar, some MLM companies put out income disclosure statements that pretend to give good information the money their distributors are making. In the case of Mary Kay, they only do an income disclosure for Canada, and only because it’s required there. You can see the pitiful numbers for 2024 here.

So they say that these paltry numbers don’t mean a lot, because they’re related to commissions paid on recruits. They don’t show the sales of products, and that’s where people are making most of their money.

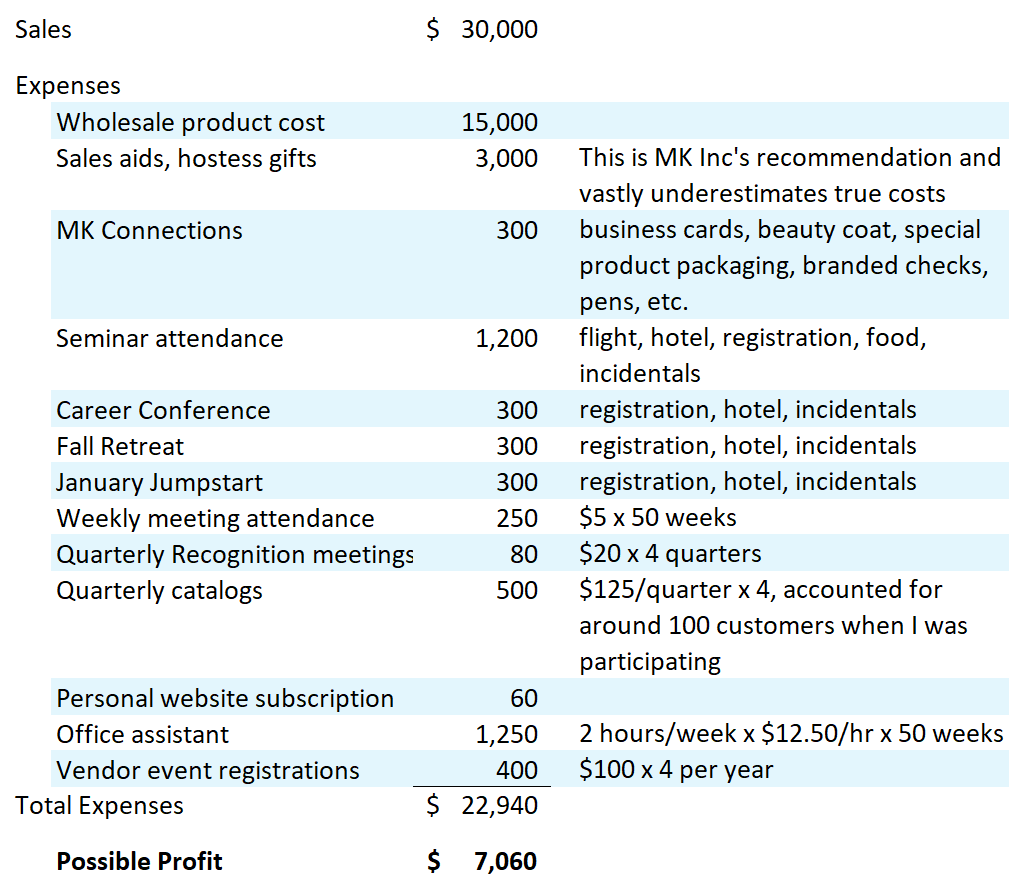

Fine. You learned yesterday that, during my 14 years as a consultant and director, I moved between $25,000 and $30,000 in retail product every year. We’re going to use $30,000 so the Kaybots can’t accuse me of skewing the numbers down. I’m also going to use Mary Kay figures on sales expenses, and assume that most products were sold at full retail price. Both grossly overestimate the amount of money a consultant is actually earning because consultants sell most products at a discount, and the expenses end up being more than they tell you. But, again, we wouldn’t want to be accused of cheating.

So, here’s the breakdown:

On $30,000 in sales, you end up with a possible profit of $7,060 for the entire year. And remember, this is only if I sold everything at full price!

But, wait! We also left off taxes (1/3 of profit), mileage (I usually put around 12,000 MK miles on my car per year), buying coffee for your prospective recruits when you meet them at Starbucks, and countless other expenses that creep in and steal your income. Especially when you run a business without a proper ledger.

So, fine. At the top of my game, as the tippy top consultant in several units, and outperforming 99% of consultants, I was coming home with a whopping $7,000 per year, if we give everything the benefit of the doubt.

That means that instead of the $17.58 per month that the income disclosure shows the average consultant making, I was earning an average of $600.91 per month.

Sure sounds like executive income to me!

The real problem shows up when you’re living like you’re working this business full-time. In absence of a true ledger, my funds were commingled and messy. I was depositing $2,500/month in the bank, and that should have been plenty to cover my bills at that time! It didn’t give me a ton of margin, but I had the cash on hand to run my household.

But I always had to choose—do I run my business, or do I run my household? Do I reorder products and keep my customers happy? Or do I pay the mortgage? Does Seminar go on a credit card or do the groceries?

The constant tension and shuffling, the lack of clarity, and the simple deficit of money created a situation where I was earning diamonds, recognized as the top seller, training other consultants on how to be successful, all while I was slowly drowning in credit card debt.

I was $24,000 in debt across several cards before I came clean to my husband and started cleaning up my mess. And I quickly learned that I couldn’t sustain all the events and ordering and everything without adding to my debt. Unless I was willing to quit. Which I finally, mercifully, did.

I’m grateful every day that it wasn’t worse.

Visit the

Visit the

The big money makers in MLMs like Mary Kay are not doing so through product sales. It has always been about recruiting. Most of the product ordered goes unsold, sold at a loss, gifted, donated or sent to the landfill.

MK does not track end-customer sales, so the real numbers are elusive. But MLMs are famous for selling more to their sales force than to outside customers. Qualifying minimums anyone? Honest participants, especially those who keep an accurate ledger, will confirm this.

I’d add supplies for creating gift sets/baskets, card processing fees, shipping costs, registration fees to participate in recruiting events, event T-shirts and themed attire (to avoid FOMO), and childcare costs so you can attend events (if you don’t have support at home) to the list of sneaky expenses as well! The spending literally never ends even as the profits come up short. Stuck in the hope cycle that they’ll get a return on their investments.

I wish financial literacy, and especially on how to conduct business, was more accessible and a priority in the U.S. education system. I imagine several know the truth about the numbers and just ignore it but I think of those who are more vulnerable and get taken advantage of because they truly don’t understand how to break down the financial aspects.

It is sad that so many are still lured in to this ‘fake world’. Worst are the ones who show up here on Fridays to dispute the truth.

This financial analysis is very telling; get out while you can if you’re in!

Happy Thanksgiving!

I did the math! Even if you assume ALL product is sold at full retail … it sucks. This was using product orders from 26,279 IBCs across the USA, representing the potential sale of $39,139,496 in product,

https://lazygardens.blogspot.com/2015/09/mary-kay-home-business-opportunity-or.html

And they were not making money.