Mary Kay Inc. Is Bleeding Money

We’ve been discussing the poor financial condition of Mary Kay Inc., as evidenced by the low commission checks of the national sales directors, the reduction of perks for the sales force, and general cutback of events and opportunities in the company. We knew money was tight, and then Mary Kay Ash’s family started suing each other and more information came out.

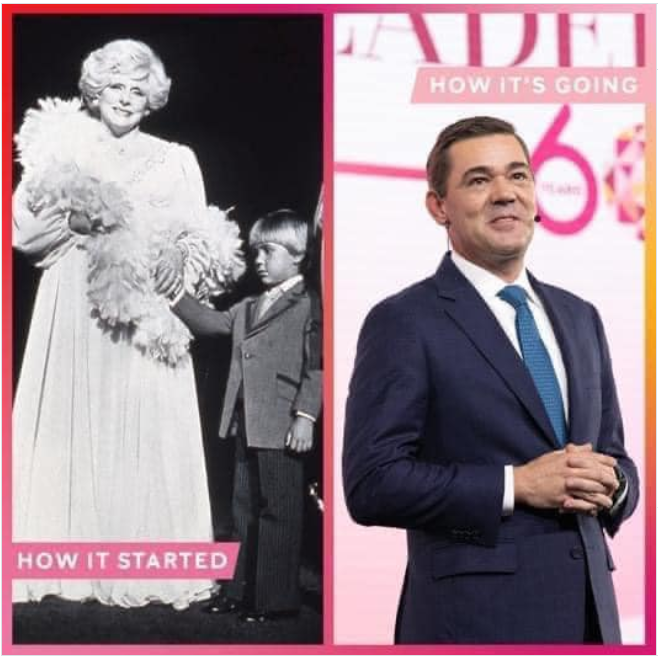

Specifically, Richard Rogers (Mary Kay’s son and former executive at MK) alleges that his son Ryan Rogers has mismanaged the company to the brink of collapse, and at the same time has lined his own pockets.

Ryan became CEO of Mary Kay Inc. in 2023, and it has been nothing short of a disaster.

Will Maddox at D Magazine wrote a very detailed article about the family fight. There are two lawsuits ongoing: the main lawsuit in Dallas and a related lawsuit in Delaware. There is a very enlightening letter included one of the filings in the Delaware litigation. Richard wrote to the board of directors of Mary Kay to expose Ryan’s complete failure as the CEO of the company and to beg them to do something before Mary Kay goes under. Here are the pertinent details from the letter Richard wrote to the board of directors:

- Sales in the first half of 2025 were 30% lower than the same period in 2021 (annual sales in 2021 were $2.08 billion)

- Mary Kay recorded operating losses of $15.9 million in the first half of 2025

- Operating income for the full year 2021 was $26.8 million

- Overall net profit in 2021 (including both operating and other activities like investing) totaled $51 million

- 2025 numbers were on pace for an estimated $46 million in LOSSES (That’s a swing of $97 million compared to 2021!!!!)

- The company’s assets dropped 24% between 2021 and 2025, down to $1.11 billion

Mary Kay Inc. is basically owned by trusts, and the beneficiaries of the trusts are family members. Every year, the company would distribute profits to the trusts, and then the trusts would invest a lot of money and make distributions to the family members from the investment earnings. The distributions from Mary Kay to the trusts last happened in 2021. So from 2022 to the present, Mary Kay has not had any money available to distribute. (It’s interesting that in late 2023, Ryan told The Dallas Morning News that MK would record over $3 billion of revenue and would be profitable for 2023. If you believe the numbers in Richard’s letter to the board, Ryan’s numbers are questionable at best. Forbes reported that 2023 sales were $2.5 billion, nowhere near Ryan’s predicted $3 billion. You decide if he was deliberately lying in that interview.)

Richard says Ryan never should have been the CEO, because he didn’t possess the experience or the work ethic needed. He is correct that Ryan is completely unqualified to be CEO. Literally, his only qualification is being a family member of the founder. Mary Kay says the following about Ryan’s work experience:

Ryan joined Mary Kay Inc. in 2000 as a Financial Analyst and held several positions including Project Manager, Director of Strategic Initiatives, and Vice President of Strategic Initiatives. In 2013, he assumed the title of Chief Investment Officer.

None of this qualifies him to run a billion dollar company. Not even close. He is in so far over his head, but I’m sure he’d never admit it.

And this is where it gets even more interesting. In addition to Richard saying his son never should have been appointed as CEO, he says that Ryan created a process by which he can take money from the trusts and do whatever he wants with it. Richard says that in 2023 alone, Ryan decided to take $37 million from the trusts.

Naturally, Ryan disputes what his dad says. After all, Ryan has a vision for growth and innovation! Furthermore, Ryan says that Richard is no longer competent and it is his gold digging wife Nancy who is pushing all of this. (Richard says no, he has medical issues that are physical only, and that he is completely mentally competent and is making his own choices.)

Ryan’s biggest problem with his dad is that Richard asked for large distributions from the trusts over the last several years. It doesn’t matter to Ryan that between 2012 and 2020, Richard took NOTHING from the trusts (even though he could have) and instead allowed his descendants to take all the trust distributions for themselves. During that period $200 million was distributed from the trusts, with Ryan himself receiving $70 million of it.

Now that dad has decided he’s going to take what he is legally and morally entitled to (instead of just allowing it all to go to his children and grandchildren), Ryan is crying foul and making hurtful allegations about his dad.

Richard says that Ryan is incapable of stopping Mary Kay’s free fall, so the company either needs to be restructured or sold. He says that the company could still be saved, but the board must act quickly.

Visit the

Visit the

“Richard say that Ryan is incapable of stopping Mary Kay’s free fall, so the company either needs to be restructured or sold.”

From your lips to God’s ears, Richard!

The bigger the estate, the bigger the family fight!

One has to wonder how much of Ryan’s decision-making is related to the company’s ability to fund the family trusts. At least he has one incentive to make the company profitable. But it would not be a stretch to assume he would prioritize tactical (short-term) needs over the strategic (long-term) health of the business. Just look how he allegedly took $37M from the trusts in a year when MKC was unable to contribute anything. This is unsustainable, short term thinking.

Any buyer would be wise to disentangle the company from those trusts and create distance from the family ASAP. The family would be wise to live off the interest income alone from the trusts without touching the principle, so that the nest-egg lasts indefinitely. Any requirement to keep funding of the family trust as part of a company purchase will be unattractive to prospective buyers.

Greed has a way of corrupting such decision-making. Based on events of the last few years, greed is likely to win out over wise counsel.

Suck-cession.

Wait until something new that I have next week about the MLM model and the where the company’s revenue comes from. This is going to be great.

I cannot wait! This is my Super Bowl.

OMG the amount of popcorn I am consuming is unreal!

I love checking the new information on this each morning! Burn, baby, burn!

For 20 years, I have been accused of wanting to “take Mary Kay down.” Nope. All I ever wanted was to make the TRUTH available to potential recruits.

But it looks like Ryan Rogers himself is single-handedly taking down Mary Kay, and i am here for it.

Ironically, it’s the family taking the Company down.

Now, let’s get back to something more important: the skirt vs pants issue…

Incredible and fascinating article- thank you Tracy.

Let’s see how those in the Fog ignore and/or spin this as they focus on silly posters and matching pajamas.

I LOVE THAT PICTURE!

Now to read the undoubtedly excellent article.

I wonder how Kristin feels about Ryan now that she is not in good standing !

It’s amazing how a company can go down so fast with the wrong person at the helm. It’s getting more and more obvious that Mary Kay Cosmetics is not doing well. Lack of innovative new products, decreasing sales tools for consultants, events have been scaled way back, shrinkage of Seminar areas, decrease in the car program, and of course the new myshop website- these are just a few signs of a failing company. I see the affiliate model coming sooner than later. Also, once a company is sold, things never remain the same. Stay tuned.

Ryan considers his My Shop idea to be innovation in the e-commerce space!

Eek I accidentally skipped the details about where this info came from but I added it! Always want to give credit to the source!

I get DMag and DCEO every month. I was actually surprised to see this article because this is more jarring than their usual positive highlights. But I’m so glad they did.

Isn’t it amazing!!!!!!?????